What Is a Surety Bond?

Learn what a surety bond is, how it works, and find answers to other frequently asked questions about the bonding process in this article

What Is A Surety Bond?

DEFINITION: SUR•E•TY BOND

A surety bond is defined as a financial guarantee that contractual obligations will be met. In other words, it is a guarantee by a third party to assume responsibility for repayment of another party’s debts if they fail to uphold contract terms or legal obligations.

The 3 Parties in a Surety Contract

Any type of surety bond is a three-party agreement between the principal (you), the surety (us) and the obligee (the entity requiring the bond).

- Principal: The principal individual or business who will perform the obligation

- Obligee: The obligee is the entity requiring the bond to guarantee fulfillment of the obligation

- Surety: The surety is the provider that issues the bond and financially upholds the obligation on behalf of the principal

How Does a Surety Bond Work?

Surety bonds provide financial guarantees that contracts and other business deals will be completed according to mutual terms.

Their primary purpose is to protect consumers, project owners and government entities from loss due to poor workmanship, malpractice, theft and fraud.

When Do I Need a Surety Bond?

You may be legally required to purchase a surety bond for numerous reasons. Many government agencies mandate surety bonds for professionals in certain industries or before issuing business licenses as a preventative measure for consumer protection.

Here are some common situations in which you might need to get a surety bond:

- You're a new business owner applying for a professional license in your state or city

- You're trying to show financial responsibility that you'll pay a bill (such as a commercial utility bill), in full and on time

- You're demonstrating your ability to fulfill court obligations as an estate administrator

- You're missing a vehicle title and need a bonded title

What Are the Types of Surety Bonds?

There are thousands of surety bonds, but most fall into one of four main categories:

- License and Permit Bonds are required as part of city, county, state or federal licensing processes.

- Construction Bonds are required to ensure construction projects are completed according to terms.

- Commercial Bonds are required to guarantee professional obligations for businesses.

- Court Bonds are required to ensure individuals fulfill their court-appointed duties.

Which Surety Bond Do I Need?

Surety bond regulations vary from state to state, and even by city or county. The best way to determine your surety bond requirement is by contacting the obligee, which probably falls into one of the following categories:

- Federal, state, county or city regulatory authority requiring a commercial surety bond

- Construction project owner or contractor requiring a contract surety bond

- Federal, state, county or municipal court requiring a court surety bond

Once you know which bond you need, you can easily apply online. SuretyBonds.com offers instant digital delivery for hundreds of bonds. Select your state below to find the surety bond you need:

What Bond Amount Do I Need?

Surety bond coverage amounts are typically determined in one of two ways:

- Fixed Amounts: The bond amount is the same for all applicants.

- Ranged Amounts: The bond amount varies depending on the applicant's license type, business volume, vehicle value, scope of obligation, etc.

Bond coverage requirements are set by the obligee (the party requiring the bond). Contact your obligee to determine the exact bond amount you need.

If the bond is for a specific license type, there is typically a fixed bond amount. However, if the bond is required for management of an estate or completion of a project, the bond amount typically matches the estate or project value.

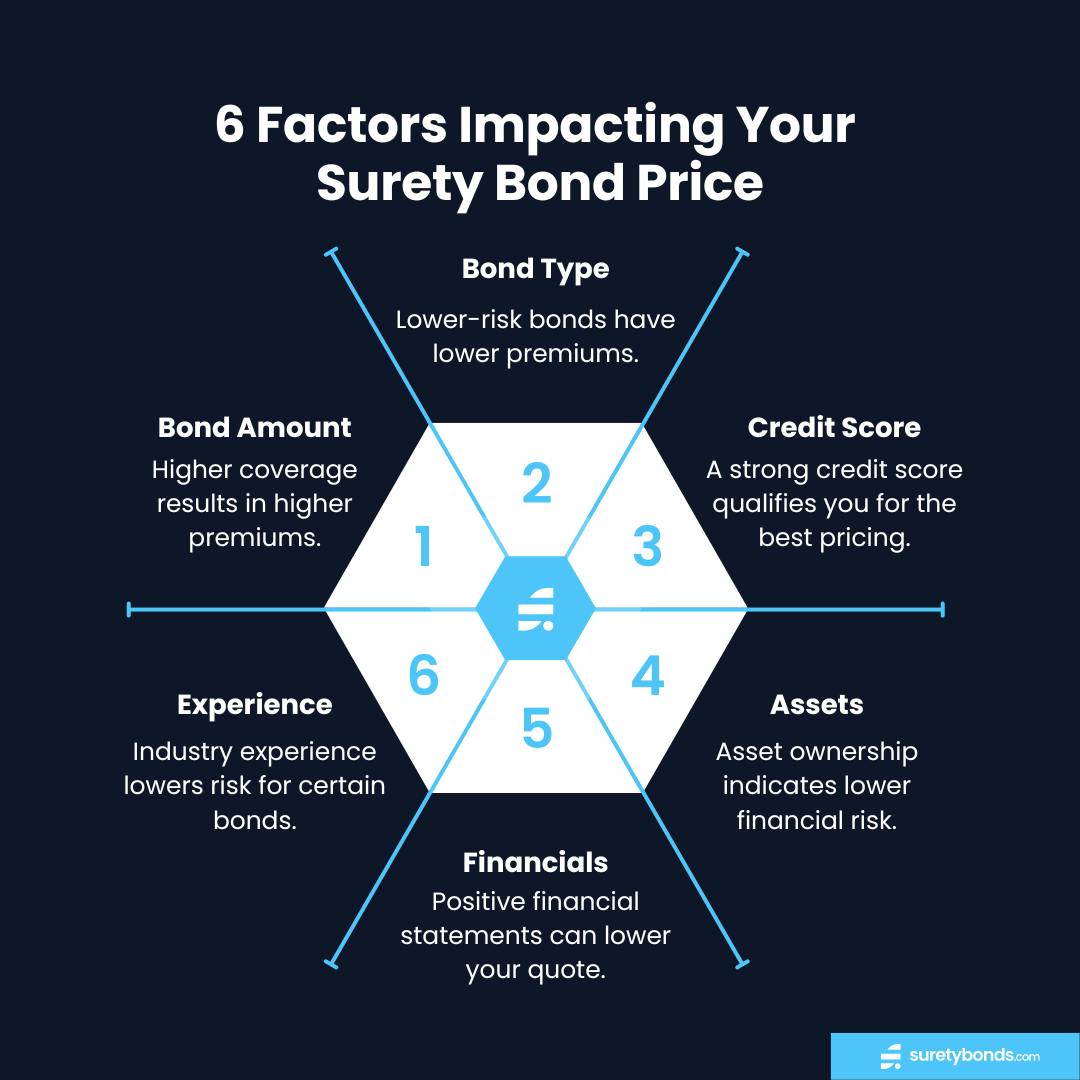

How Much Does It Cost to Get a Surety Bond?

The cost of a surety bond ranges between 0.5 to 10% of the bond amount in most cases.

Some bonds cost a fixed premium for every applicant. However, underwritten bond premiums are calculated based on the amount of coverage, bond risk and the principal’s financial history.

A bond’s jurisdiction could also affect your surety rate. For exact pricing information, apply for a free quote in under two minutes.

Does It Cost to Apply for a Bond?

No, the surety bond application process is completely free! Apply today and receive a quote within one business day — or instantly for certain bonds.

When Do I Have to Pay for My Surety Bond?

Surety providers almost always require full upfront payment before they issue a bond. We accept credit/debit cards for quick payment online or over the phone. Our online payments are backed by SSL for your safety and privacy.

Where Can I Get a Surety Bond?

You can purchase a surety bond online from a licensed surety broker or agency. Simply apply for a quote online, pay for your bond, and file it with the obligee.

SuretyBonds.com is the leading surety provider in the nation, offering the fastest and easiest bonding process. Apply today to experience our best-in-class service!

Secure | No Obligation | Takes 2 Minutes

Why Choose SuretyBonds.com?

We’ve been around since 2009 and are the industry leaders in creating a fast, easy and affordable bonding process. SuretyBonds.com is:

- Licensed in all 50 states

- Available Mon–Fri with friendly customer support 7 am–7 pm

- Backed by over 18,000 5-star customer reviews

As an agency, we provide the most competitive rates using our network of providers. Plus, we charge zero brokerage fees, provide free quotes, and even offer bad credit bond approval options.

What Does It Mean to be Bonded Under a Surety Bond?

Being “bonded” means you purchased and filed a surety bond. This guarantees you will fulfill a specific obligation, which is sometimes required by a legal contract, court order or licensing requirement.

If a bonded person or entity fails to uphold their bond terms, the surety will repay valid claims up to the full bond amount — protecting consumers and public entities from losses. The surety then recoups the cost from the bonded principal.

How Are Surety Bonds Different From Insurance Policies?

Bonds and insurance policies are separate means of financial protection:

- Insurance is a risk-transfer tool between two parties where individuals exposed to similar risks contribute premiums into a pool.

- Surety bonds act as risk-mitigation contracts between three parties where financial loss is not expected.

Insurance policies act as a retroactive protection, while bonds function more like a line of credit. Read more about standard insurance vs “surety insurance.”

What If I Don’t Have a Final Business Name or Address?

You don’t need a final business name or address to apply for a quote with SuretyBonds.com. You should, however, have a professional business name and address before submitting payment.

What’s the Difference Between Sureties and Guarantees?

Guarantees and sureties are both legal instruments that create more security in business contracts. You may hear the terms used interchangeably, but the legal definition of a surety bond is different from a guarantee.

- Sureties: Join the business deal as a third-party and offer a layer of security that the contract will be fulfilled by issuing a surety bond.

- Guarantees: Create an independent financial commitment outside of the contract in which the guarantor is financially responsible if the principal defaults.

What If There's an Error on My Bond?

If there is an error on your bond form, contact your surety provider immediately. Bonds are legally-binding contracts, so even if there is a simple typo, obligees will not accept erroneous forms. Ensure that you provide 100% accurate information when applying to prevent this.

What If I Need to Change the Information on My Bond?

If there is a small problem with your active bond form, your obligee may accept a bond rider document that can be attached to the original bond. In other cases, the surety may have to cancel the original and issue a completely new bond.

You cannot alter your bond form without submitting a change request to your provider. Reach out today if you need to update your SuretyBonds.com bond form.

How Do I Renew My Surety Bond?

If you purchased your bond from SuretyBonds.com, your account manager will begin contacting you 90 days before your bond’s expiration date. You’ll simply pay your renewal premium and file any additional documentation as needed. Visit our edu page to learn more about surety bond renewal:

Want to Learn More?

Visit our Surety Bond Education Hub — your one-stop shop for bond information and FAQs.