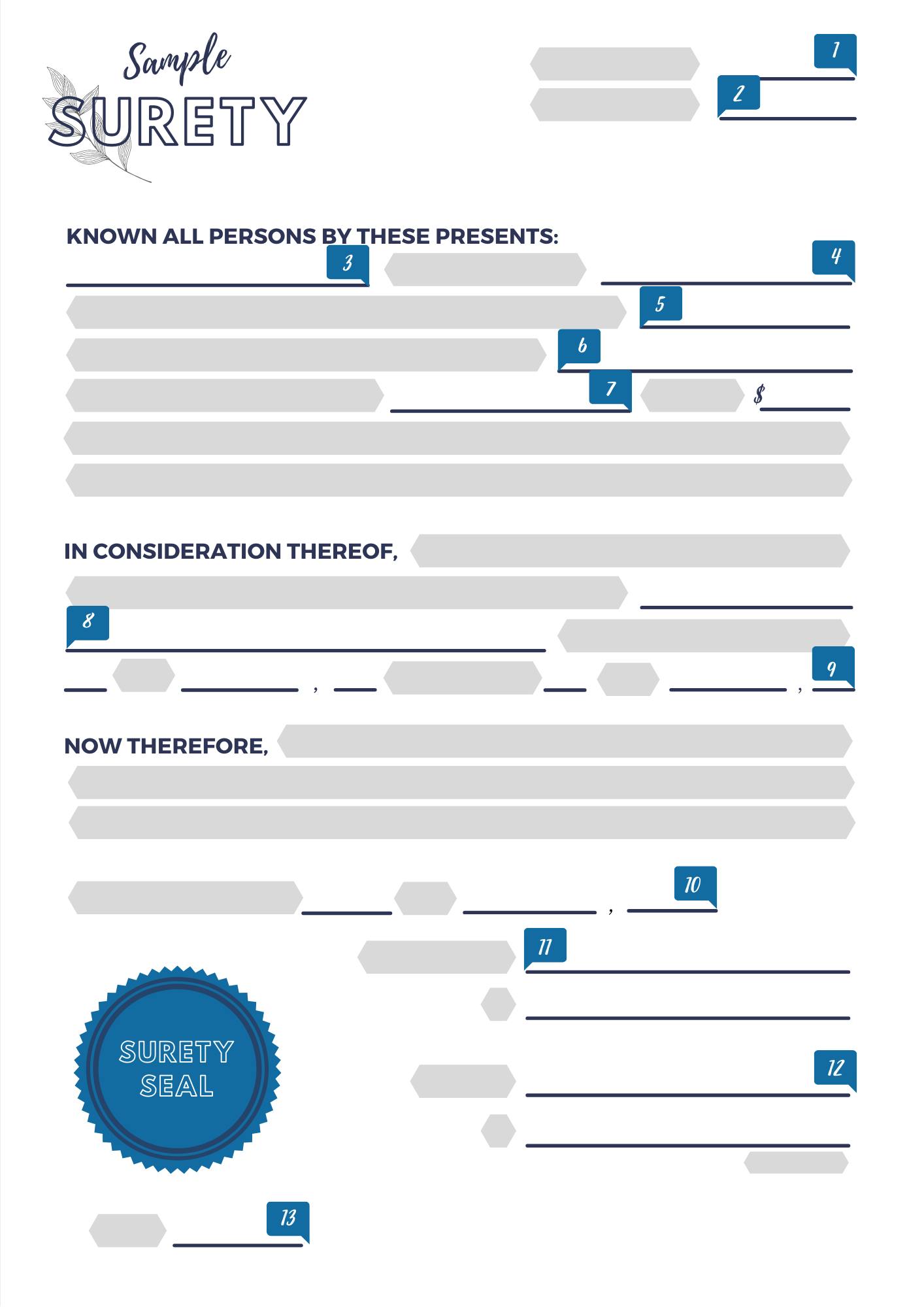

Surety bond forms are legal documents that outline an agreement between you, a surety company and an obligee who requires the bond. They can be confusing at first glance and may contain unfamiliar terms.

Follow this guide to learn how to understand and fill out a surety bond form before submitting it to your obligee.

What Are the Components of a Surety Bond Form?

Here are the 13 general components you can expect to find in most surety bond forms:

1. Bond Number

The bond number is the unique identification number assigned to your bond. You’ll get this number from your surety bond agent when they issue your bond.

2. Bond Premium

This is the cost of your bond, typically calculated as a percentage of your bond coverage.

3. Principal Name

Your name or the business name your registration documentation is filed under. The name must match the underlying agreement, application or proposal associated with the bond.

4. Surety Name

The name of the company backing your bond must be listed to prove your bond is valid.

SuretyBonds.com will NOT be listed as the surety company. We are an agency that connects you to the top surety companies.

5. State of Incorporation

The state of incorporation is where the surety company is established. This does not have to match the state the bond is for as long as the surety is licensed in said state.

6. Obligee Name

The legal name of the entity requiring the bond. This is typically a government agency, but can also be a project owner for contract bonds, for example.

7. Bond Amount

The amount of liability coverage for your bond must be written out and/or listed numerically. The bond amount required is determined by the obligee.

8. Bond Obligation

A summary of the bond’s terms and conditions. Surety bonds have different requirements based on the industry, state or even the obligee.

For example, probate, title and lost instrument bonds require a financial guarantee. Other bond types, such as contractor bonds, may require a license type or classification to be listed.

Be sure to provide all pertinent information when you apply to ensure all requirements are fulfilled.

9. Effective Term

This is where the bond’s effective start and end dates will be listed. Keep in mind that the obligee determines how the bond is written, and there may not always be an end date on the form.

10. Sign and Seal Date

This is the date that the signatures are completed.

11. Principal Name and Signature

The principal purchasing the bond must sign the bond where prompted. If the bond is in an individual’s name, you must sign, matching the legal printed name. If the principal is a company, an authorized representative will sign the bond where indicated.

12. Surety Signature

An attorney-in-fact for the surety company must sign the bond form. The company name should appear next to the signature. Oftentimes, the bond will come with a power of attorney, which grants the individual authority to sign on behalf of the surety company.

13. Bond Form Number

The bond form number indicates the specific type of obligation the bond fulfills. An obligee can reference this bond number to determine exactly what license or registration the bond is for and the specific terms that apply to it.

Surety bond forms may vary according to specific obligee's requirements or which surety company the bond is issued by. The various components of the bond document may be phrased differently or placed in different locations.

Defining Surety Bond Form Terms

Bond Premium: The amount you must pay for the bond. This is different from the bond liability or penal sum, which refers to the amount of coverage you receive with the bond.

Obligee: The party a bond protects from loss: the beneficiary of the bond. For example the project owner on a construction site or the licensing authority for mortgage professionals in a certain state.

Cancellation Clause: The clause in the surety bond that states information about the bonds cancellation policy. It includes how long the bond is valid for, and whether or not it’s cancellable by the surety company.

Principal: The person or business whose obligations are financially guaranteed by a bond.

Indemnity: An indemnity clause states that the principal agrees to repay the surety company for any losses incurred due if the principal fails to fulfill their obligations.

Will I Need a Physical or Digital Copy of My Bond Form?

Whether you’ll need a physical or digital copy of your bond depends on the obligee. You can contact your obligee directly, or our account managers can confirm their required delivery method. Regardless, you must sign your bond as the principal before you can be considered officially bonded.

How Do I Know If I Filled Out My Form Correctly?

Our account managers will confirm that all of your information is filled out correctly before issuing your official bond documentation. Typically, you only need to sign and date your bond form before submitting it to the obligee. We do the rest!