Indemnity bonds are a common type of surety bond. They guarantee contract fulfillment to the obligee while holding the principal liable for repaying the surety if a claim is made against the bond.

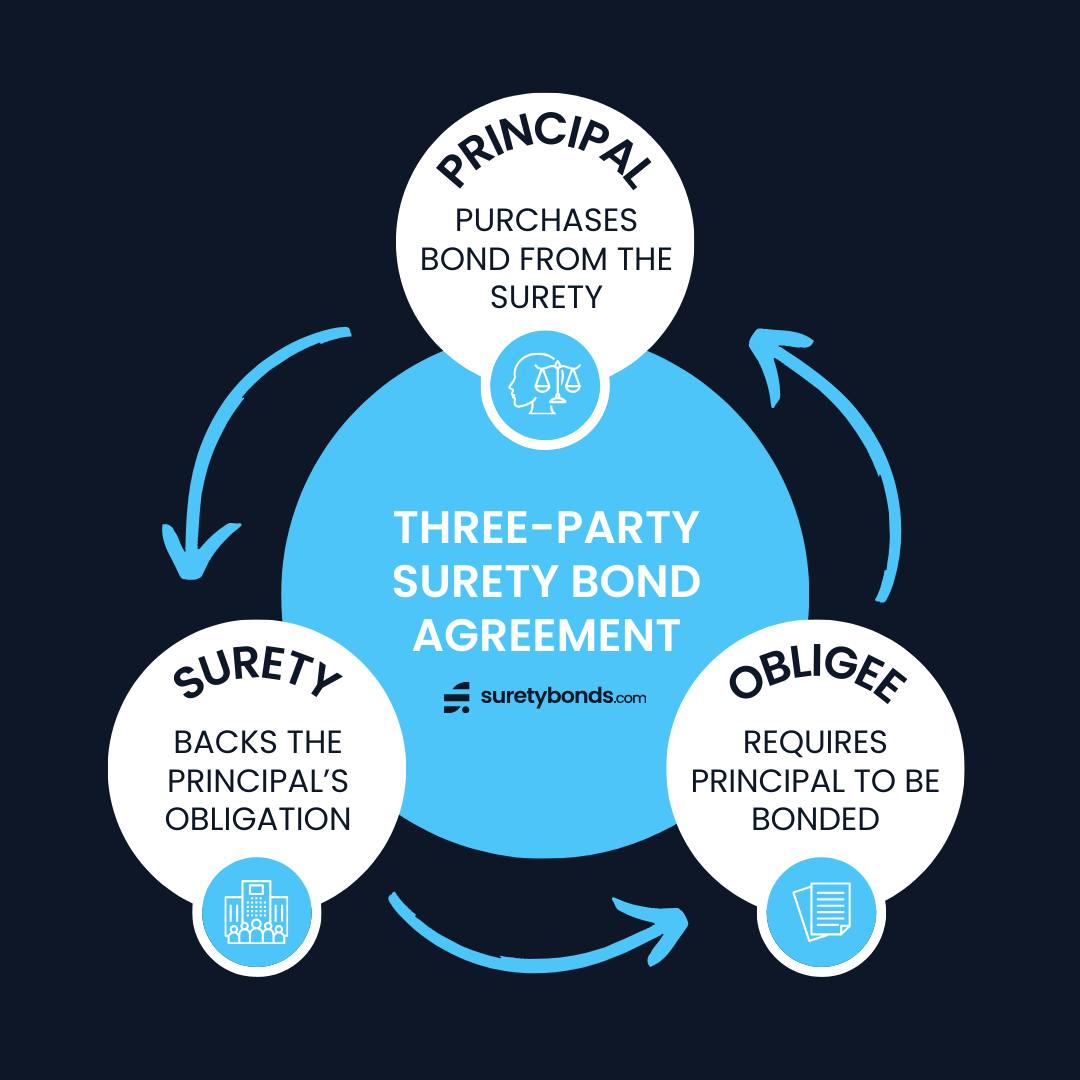

Like all surety bonds, an indemnity bond is three-party contract between a:

- Principal: Business or individual who purchases the bond from the surety

- Surety: Provider who issues the bond to the principal

- Obligee: Entity that requires the principal to file a bond

How Does an Indemnity Bond Work?

Indemnity bonds protect the public from monetary loss by holding business owners, license holders and contractors liable for their professional obligations.

An indemnity bond covers the obligee from financial loss if the principal fails to perform. For example, if a contractor does not complete a project, the surety can collect payment from the contractor to cover the expenses of finding a new contractor.

Surety Bond vs Indemnity Bond: What’s the Difference?

Indemnity bonds are a type of surety bond, but not all surety bonds are indemnity bonds. If a bond can be instantly issued without underwriting or a credit check, it is not an indemnity bond.

However, nearly every underwritten bond must be accompanied by a signed hold harmless indemnity agreement. Learn more in our Guide to Surety Bond Indemnity Agreements.

When Do You Need an Indemnity Bond?

Personal indemnity is necessary for bonds with greater risk, often due to a high bond amount, specific line of work or bond terms that increase the likelihood of claims.

Here are some common types bond types that often require indemnification:

- License & Permit Bonds: Hold license and permit holders liable to industry regulations

- Construction Bonds: Ensure contractors complete construction projects properly

- Commercial Bonds: Protect consumers from business malpractice

- Fidelity Bonds: Guard employers from loss due to employee theft or fraud

- Lost Instrument Bonds: Prevent duplicate checks from being cashed

How Much Does an Indemnity Bond Cost?

An indemnity bond costs a small percentage of the total coverage amount — typically 0.5–10%. This means a $50,000 indemnity bond may cost $250–$5,000.

For qualified applicants, most premiums are 1-4% of the bond amount. Apply today to get an exact quote for the indemnity bond you need.

Do You Get the Money Back for an Indemnity Bond?

No — the surety covers the cost of a claim upfront, but you must pay them back under the indemnity agreement terms. Indemnity bond premiums are also non-refundable once you file your official bond.

Where Do I Buy an Indemnity Bond?

Purchase your indemnity bond from the nation’s leading surety provider, SuretyBonds.com. We offer the easiest and fastest bonding process in the industry!

Apply online in minutes and receive a quote within one business day. If you have any questions, our friendly Customer Care Team is available Monday–Friday.