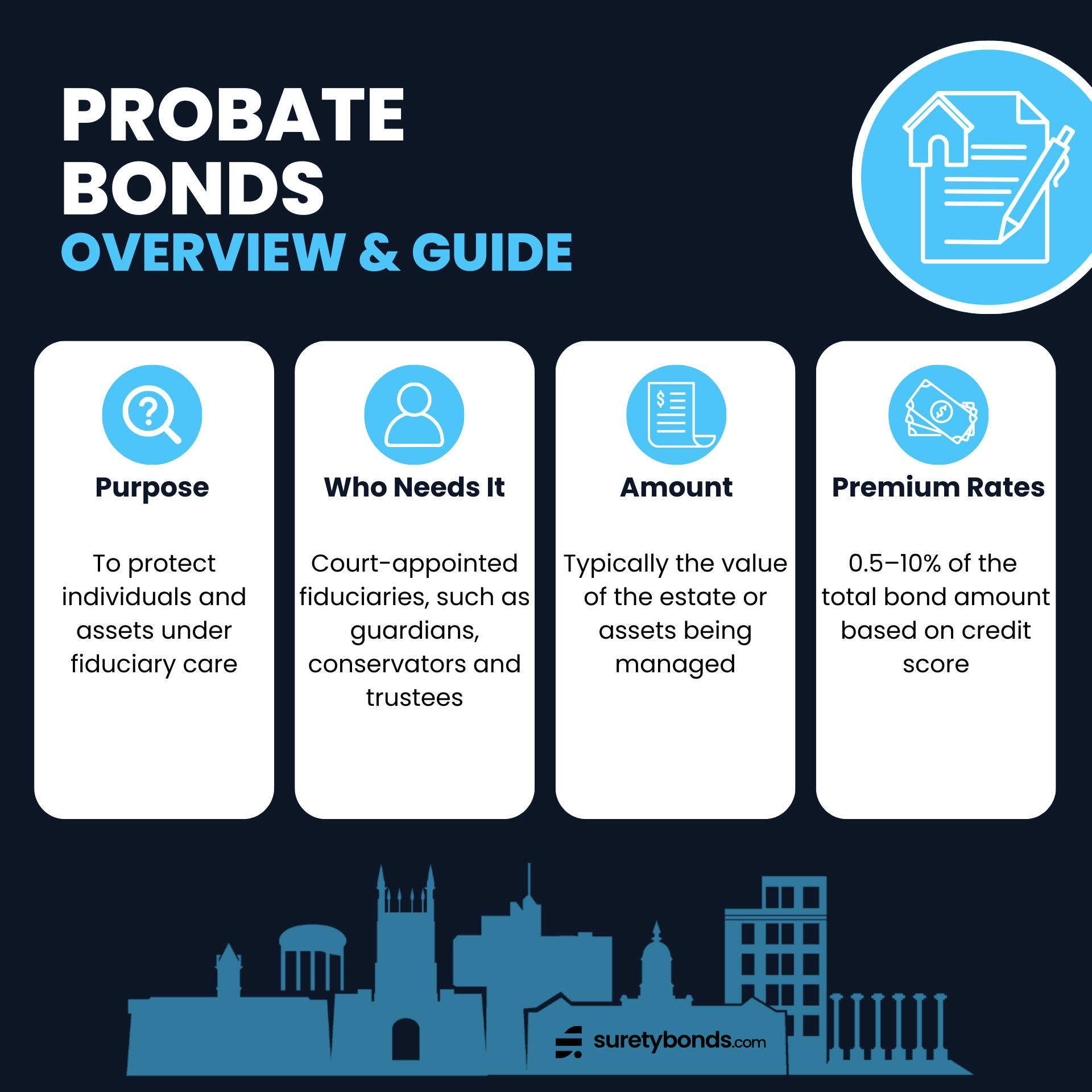

Probate & Estate Bond Guide

Learn how bonds for estate management work in this complete probate bond guide.

- Purpose: To protect individuals and assets under fiduciary care

- Premium Rates: 0.5–10% of the total bond amount based on credit score

- Bond Amount: Typically the value of the estate or assets being managed

- Who Needs It: Court-appointed fiduciaries, such as guardians, conservators and trustees

SuretyBonds.com is legally licensed to sell probate and fiduciary bonds in every state. We offer the best service, fastest delivery and most affordable prices in the industry.

What Is a Probate Bond?

Probate bonds are a category of court surety bonds required when individuals are appointed to act on behalf of others through the probate process. Probate bond and fiduciary bond are interchangeable terms.

What Is a Fiduciary?

A fiduciary is a person given power over another’s interests and assets, including executors, administrators, guardians, trustees and conservators, in probate court. The probate process is the legal procedure in which the assets and wishes of a deceased individual are carried out.

Types of Probate and Estate Bonds

There are a variety of probate and estate management bond sub-types that courts require for different types of fiduciaries and circumstances.

- Child Custody Bonds: Protect children involved in divorce proceedings from custody violations and safety risks.

- Custodian/Guardianship Bonds: Ensure an appointed custodian will care for an individual and their finances honestly and legally.

- Executor Bonds: Ensure estates are managed according to the wills of the deceased.

- Nominal Bonds of Personal Representative (Maryland): Prevent fraud or embezzlement for court-appointed personal representatives in Maryland.

- Receiver/Receivership Bonds: Protect property and assets when an individual or company is facing legal disputes.

- Trustees, Mortgagees, Attorneys or Foreclosure Bonds: Guarantee fulfillment of court orders regarding the sale of a foreclosed property.

- VA Fiduciary Bonds: Allow veterans’ friends and family members to act as their fiduciaries.

How Does a Probate Bond Work?

A probate surety bond provides a financial guarantee that the principal will fulfill their fiducial obligation according to the court’s terms. The bond contract involves three parties:

- Principal: The individual performing fiduciary duties and purchasing the bond

- Obligee: The entity requiring the bond: the estate administrator or executor

- Surety: The provider issuing the bond and backing the principal

How Much Does a Probate Bond Cost?

Probate & estate bond costs vary depending on the amount of coverage needed, which is based on the value of the estate.

Probate/fiduciary bond premiums typically cost 0.5% for the first $250,000 of coverage. This means a $100,000 probate court bond would cost just $500. To determine your exact price, request a quote now.

How Do I Get a Probate Bond?

To apply for a probate bond, you will need to submit court documents related to the case. Depending on the associated risk, the surety provider may require a review of your financial credentials, such as a credit report.

Ready to apply? Fill out our online application or call to speak with a SuretyBonds.com expert.

What Does a Fiduciary Bond Cover?

Fiduciary bonds help protect estates and beneficiaries from fraud, embezzlement and other illicit acts. Depending on the situation, a fiduciary could be responsible for:

- Inventorying and protecting the assets of an estate

- Arranging estate appraisal

- Paying off debts of the estate

- Ensuring correct tax calculations and payment

- Disbursing assets among beneficiaries and heirs

- Making personal care decisions for another

A probate surety bond offers family members, heirs and other stakeholders an avenue of recourse if the fiduciary were to take advantage of their appointment.

How Long Does It Take to Get a Probate Bond?

SuretyBonds.com offers the fastest way to get a probate bond! Start by filling out our online application. We’ll provide a digital invoice within one business day.

If you need your fiduciary bond the next day, select overnight shipping at checkout.

More Fiduciary Bond FAQs

Is a Fiduciary Bond the Same as a Surety Bond?

Surety bonds are three-party contracts that ensure certain obligations are upheld. A fiduciary bond is a specific type of surety bond that may be required for individuals appointed fiducial responsibilities.

What's the Difference Between an ERISA Bond and a Fiduciary Bond?

Both are surety bonds that work to protect individuals and their assets, but they are not the same.

- ERISA bonds are a type of fidelity bond to protect individuals who contribute to employee retirement plans.

- Fiduciary bonds are a type of court bond to protect beneficiaries and estates of deceased or incapacitated individuals.

Is a Probate Bond Refundable?

While the principal is responsible for paying for the bond, personal representatives of an estate can typically be reimbursed using the estate funds. This does not apply to any claims made against the bond.

When Is a Bond Required for Probate?

It is a good idea for all state executors and administrators to get a probate bond.

They are always required if the will or trust of the decedent is specified as such. In other cases, it may be up to the court to decide. For example, if the estate has significant remaining debt, bonding is typically required by the court.

Learn more about bonds for estate administration.